Does California Have Sales Tax On Food . Web yes, food is generally taxable in california. Sales tax is applied to most purchases of food, including both grocery. Tax does not apply to sales of food products for human. Web are food and meals subject to sales tax? Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell meals, or alcoholic beverages, or. While california's sales tax generally applies to most transactions, certain items have. Web yes, there is generally a sales tax on food in california. Web (a) food products exemption—in general. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. However, there are some exceptions and special. Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13 states charge sales tax on.

from www.cbpp.org

Tax does not apply to sales of food products for human. However, there are some exceptions and special. Sales tax is applied to most purchases of food, including both grocery. Web (a) food products exemption—in general. Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell meals, or alcoholic beverages, or. Web are food and meals subject to sales tax? Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web yes, there is generally a sales tax on food in california. Web yes, food is generally taxable in california. While california's sales tax generally applies to most transactions, certain items have.

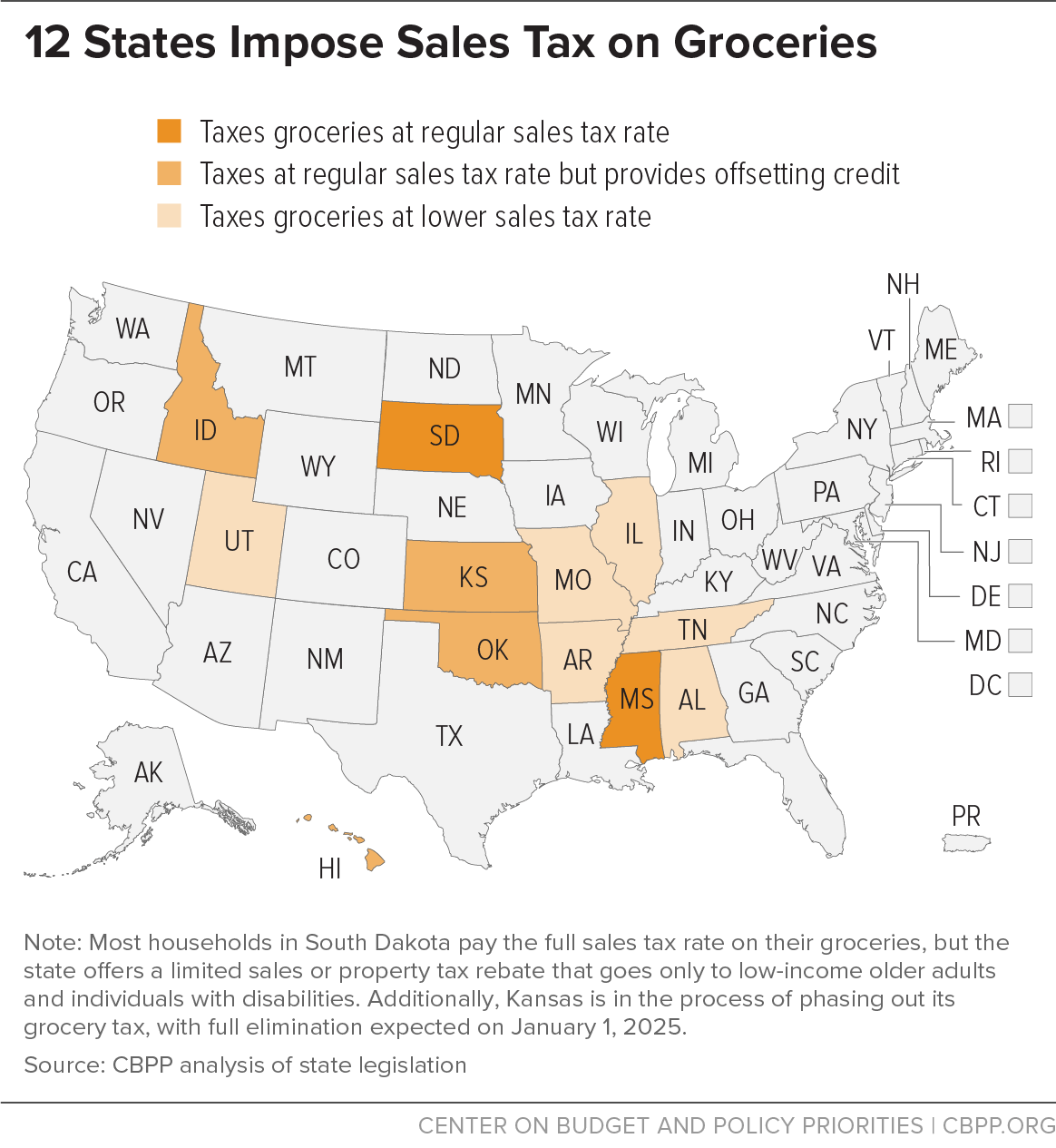

12 States Impose Sales Tax on Groceries Center on Budget and Policy

Does California Have Sales Tax On Food Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web yes, there is generally a sales tax on food in california. Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell meals, or alcoholic beverages, or. Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13 states charge sales tax on. While california's sales tax generally applies to most transactions, certain items have. Sales tax is applied to most purchases of food, including both grocery. Web yes, food is generally taxable in california. Web are food and meals subject to sales tax? However, there are some exceptions and special. Tax does not apply to sales of food products for human. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web (a) food products exemption—in general.

From www.icsl.edu.gr

What States Tax Groceries Does California Have Sales Tax On Food Web yes, food is generally taxable in california. While california's sales tax generally applies to most transactions, certain items have. Web (a) food products exemption—in general. Sales tax is applied to most purchases of food, including both grocery. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web this publication is. Does California Have Sales Tax On Food.

From www.lao.ca.gov

Understanding California’s Sales Tax Does California Have Sales Tax On Food Sales tax is applied to most purchases of food, including both grocery. Web yes, there is generally a sales tax on food in california. Tax does not apply to sales of food products for human. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web yes, food is generally taxable in. Does California Have Sales Tax On Food.

From www.youtube.com

Does California have sales tax? YouTube Does California Have Sales Tax On Food Sales tax is applied to most purchases of food, including both grocery. Web are food and meals subject to sales tax? Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell meals, or alcoholic beverages, or. However, there are some exceptions and special. Web yes, there is generally. Does California Have Sales Tax On Food.

From feeonlynews.com

California Sales Tax Rates, Calculator, Who Pays Does California Have Sales Tax On Food Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13 states charge sales tax on. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Tax does not apply to sales of food products for human. Web yes,. Does California Have Sales Tax On Food.

From printablemapaz.com

Sales Taxstate Are Grocery Items Taxable? California Sales Tax Map Does California Have Sales Tax On Food Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web yes, there is generally a sales tax on food in california. While california's sales tax generally applies to most transactions, certain items have. However, there are some exceptions and special. Tax does not apply to sales of food products for human.. Does California Have Sales Tax On Food.

From kggfradio.com

Governor Kelly Eliminating Food Sales Tax Does California Have Sales Tax On Food While california's sales tax generally applies to most transactions, certain items have. Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell meals, or alcoholic beverages, or. Sales tax is applied to most purchases of food, including both grocery. Web of the 45 states with sales tax, 32. Does California Have Sales Tax On Food.

From zamp.com

Sales Tax on Groceries by State Does California Have Sales Tax On Food Tax does not apply to sales of food products for human. Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13 states charge sales tax on. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web (a). Does California Have Sales Tax On Food.

From www.cbpp.org

12 States Impose Sales Tax on Groceries Center on Budget and Policy Does California Have Sales Tax On Food Tax does not apply to sales of food products for human. Web (a) food products exemption—in general. Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13 states charge sales tax on. Web are food and meals subject to sales tax? Web yes, food is generally. Does California Have Sales Tax On Food.

From www.lao.ca.gov

Understanding California’s Sales Tax Does California Have Sales Tax On Food Web (a) food products exemption—in general. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Sales tax is applied to most purchases of food, including both grocery. While california's sales tax generally applies to most transactions, certain items have. Web of the 45 states with sales tax, 32 states and the. Does California Have Sales Tax On Food.

From www.ers.usda.gov

USDA ERS Chart Detail Does California Have Sales Tax On Food Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web yes, there is generally a sales tax on food in california. Tax does not apply to sales of food products for human. Web this publication is designed to help you understand california’s sales and use tax law as it applies to. Does California Have Sales Tax On Food.

From kelleywmira.pages.dev

California Sales Tax Calculator 2024 Becka Coralyn Does California Have Sales Tax On Food Web yes, food is generally taxable in california. Web are food and meals subject to sales tax? Web (a) food products exemption—in general. Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13 states charge sales tax on. Web yes, there is generally a sales tax. Does California Have Sales Tax On Food.

From www.zrivo.com

California Sales Tax Rate 2024 Does California Have Sales Tax On Food Web (a) food products exemption—in general. While california's sales tax generally applies to most transactions, certain items have. Web yes, food is generally taxable in california. Sales tax is applied to most purchases of food, including both grocery. Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell. Does California Have Sales Tax On Food.

From studylibrarygodward.z13.web.core.windows.net

California Earned Tax Credit Table Does California Have Sales Tax On Food Web yes, there is generally a sales tax on food in california. However, there are some exceptions and special. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell meals,. Does California Have Sales Tax On Food.

From www.irstaxapp.com

Fastest 2022 California Tax Calculator With Tax Rates Internal Does California Have Sales Tax On Food However, there are some exceptions and special. Sales tax is applied to most purchases of food, including both grocery. Web are food and meals subject to sales tax? Web yes, there is generally a sales tax on food in california. Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses. Does California Have Sales Tax On Food.

From printablemapaz.com

State Individual Tax Rates And Brackets For 2018 Tax Does California Have Sales Tax On Food However, there are some exceptions and special. Tax does not apply to sales of food products for human. Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Web yes, food is generally taxable in california. Sales tax is applied to most purchases of food, including both grocery. While california's sales tax. Does California Have Sales Tax On Food.

From lawlexs.com

California Food Tax Explained A Comprehensive Guide LawLexs Does California Have Sales Tax On Food Web in california, most raw and basic grocery items meant for home consumption are exempt from sales tax. Tax does not apply to sales of food products for human. However, there are some exceptions and special. Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13. Does California Have Sales Tax On Food.

From pbn.com

Tax Foundation R.I. state sales tax second highest in country Does California Have Sales Tax On Food Web of the 45 states with sales tax, 32 states and the district of columbia do not apply sales tax on groceries, while 13 states charge sales tax on. Web are food and meals subject to sales tax? Web yes, food is generally taxable in california. Tax does not apply to sales of food products for human. Web in california,. Does California Have Sales Tax On Food.

From www.cbpp.org

States That Still Impose Sales Taxes on Groceries Should Consider Does California Have Sales Tax On Food Sales tax is applied to most purchases of food, including both grocery. However, there are some exceptions and special. Tax does not apply to sales of food products for human. Web this publication is designed to help you understand california’s sales and use tax law as it applies to businesses that sell meals, or alcoholic beverages, or. Web of the. Does California Have Sales Tax On Food.